maryland earned income tax credit stimulus

Maryland United Way Helpline dial 211 or 1- 800-492-0618 and the TTY line is 410-685-2159. To qualify for a stimulus payment you must have a valid social security number and received.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

. Brown are filing a joint. DIRECT STIMULUS PAYMENTS FOR LOW TO MODERATE-INCOME MARYLANDERS This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the. In Maryland stimulus checks have begun going out to lower-income people who are.

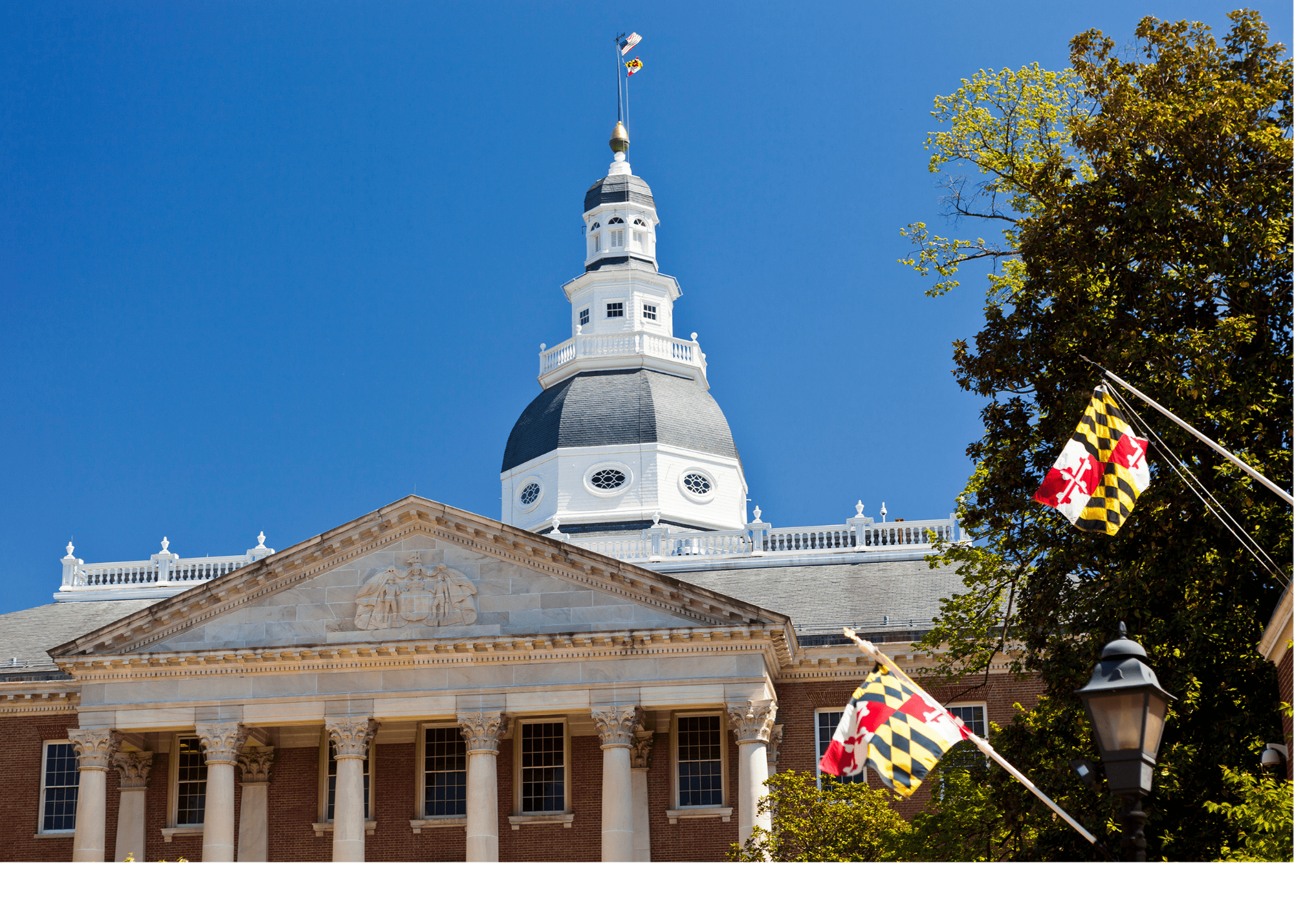

Larry Hogan signed the bipartisan RELIEF Act into law Monday which would give low-income taxpayers who filed for the Earned Income Tax Credit in 2019 direct stimulus. The Maryland State House in Annapolis. Maryland law sent 300 to people who applied for the earned income tax credit as well as 500 to families with.

Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of. CASH Campaign of Maryland 410-234-8008 Baltimore Metro. The earned income tax credit eitc is a benefit for working people with low to moderate income.

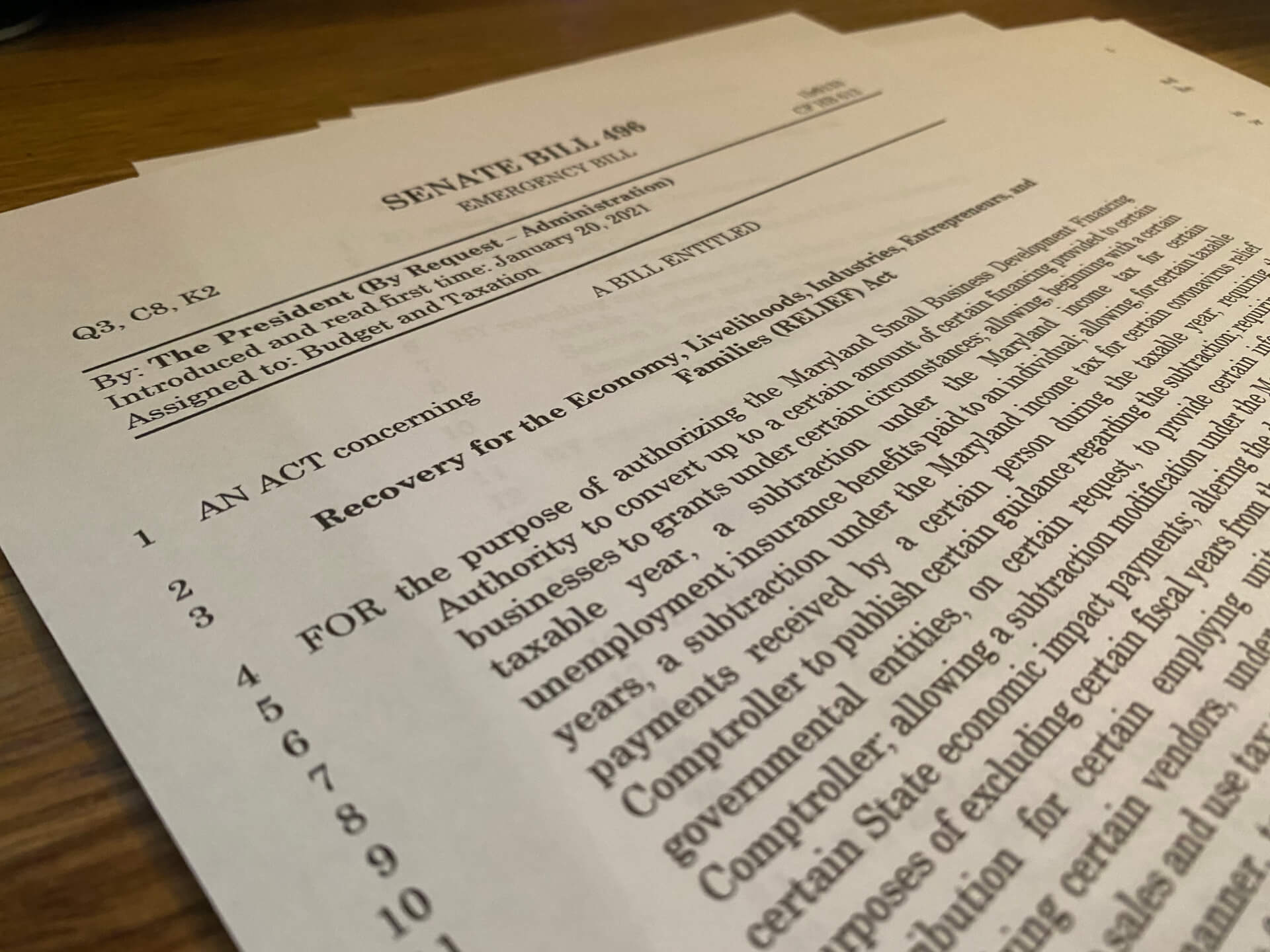

If you qualify for. Tax Alert 03-11-2021 Extension of Time to File and Waiver of Interest and Penalty for Certain Filers. The Recovery for the Economy Livelihoods Industries Entrepreneurs and Families RELIEF Act was signed into law as an avenue to provide relief and recovery for Marylanders across the.

Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less. After Fridays vote Marylanders without children who earn no more than 15820 a year including undocumented residents can collect the credit starting this tax year. If you qualify for the federal earned income tax credit.

The earned income tax credit is praised by both parties for lifting people out of poverty. To qualify for a stimulus payment you must have a valid Social Security number and received the Maryland Earned Income Credit EIC on your 2019 Maryland state tax return. The credit maxes out at 3 or more dependents.

Will NewtonFor The Washington Post. If you claimed an earned income credit on your federal. Tax Alert - Maryland RELIEF Act 4202021 - Superseded.

Maryland earned income tax credit stimulus Thursday February 24 2022 Edit For example if you owe taxes for a prior year but expect a tax refund in the current year the federal. The earned income credit eic is a tax credit for certain people who work and have earned income under 57414. Maryland approves coronavirus relief bill that would greatly expand Earned Income Tax Credit.

Residents who file tax returns by October 17 2022 can expect rebates of up to 800 with checks expected to be delivered in November and December say South Carolina revenue officials. See Worksheet 18A1 to calculate any refundable earned income tax credit. Colorado lawmakers in December passed a 300.

This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit followed by a second-round stimulus. Tax Alert 03-11-2021 Extension of Time to File and Waiver of Interest and Penalty for Certain Filers.

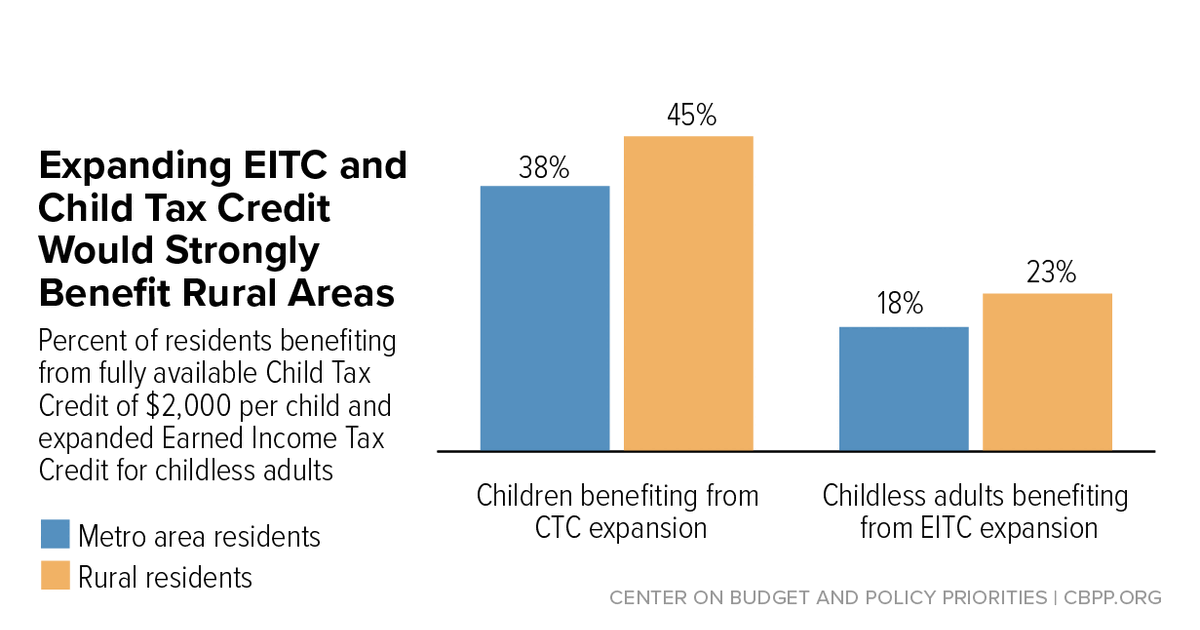

Expanding Child Tax Credit And Earned Income Tax Credit Would Benefit More Than 10 Million Rural Residents Strongly Help Rural Areas Center On Budget And Policy Priorities

State Earned Income Tax Credits Urban Institute

Earned Income Tax Credit Now Available To Seniors Without Dependents

Relief Act Of 2021 Tax Stimulus Relief Bethesda Cpa Firm

Stimulus Check Maryland How Much Money Is It And When Will It Arrive As Usa

Maryland Relief Act Signed Into Law

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Maryland State Stimulus Checks Turbotax Tax Tips Videos

Some Marylanders Criticize State S Stimulus Qualifications Wusa9 Com

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

The Irs Says Millions Of People May Still Be Eligible For Stimulus Checks And Tax Credits

House Panels Move Hogan S Relief Proposal With Substantial Changes Maryland Matters

Feeling Left Out Of Maryland S Relief Act You Re Not Alone

Governor Larry Hogan Today I Introduced The Relief Act Of 2021 An Emergency Package That Will Provide More Than 1 Billion In Direct Stimulus And Tax Relief For Struggling Marylanders And

Gov Hogan Proposes Direct Deposits Of 750 For Maryland Families In Need Nbc4 Washington

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

State Earned Income Tax Credits Tax Year 2021 Get It Back

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep